WSU612019Income TaxPart-I E-33306 Date. Percentage of Employee Contribution to EPF.

How To View Epf Passbook And Track Contributions Interest Transfer Withdrawal

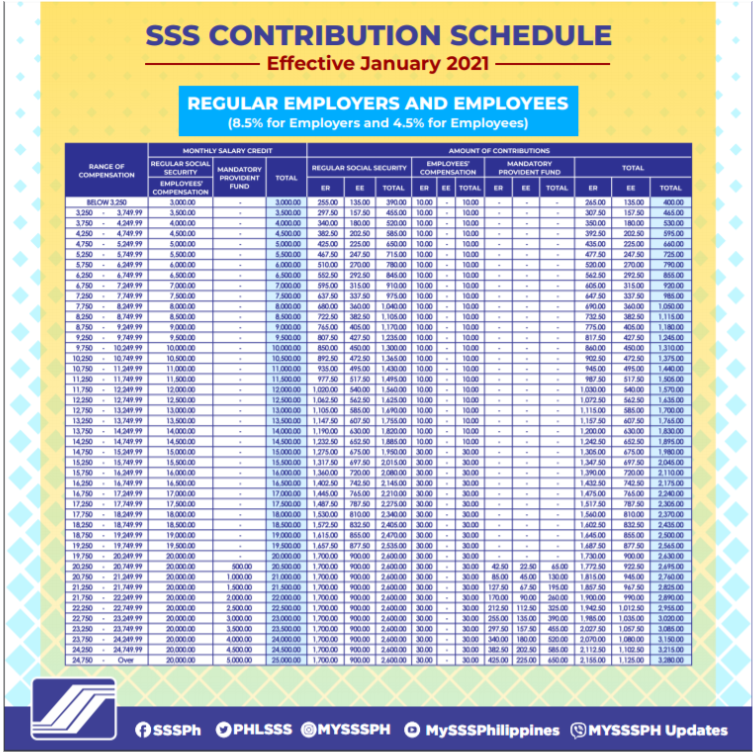

The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme.

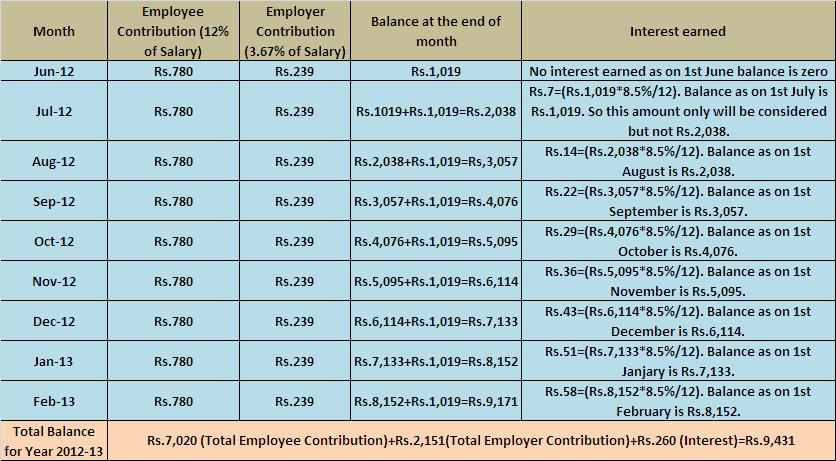

. CPFC Zones All Regional PF. Commissioners Incharge of Regional Offices. In the year 2016 or 2017 EPF introduced a few changes employees started thinking that if they dont contribute for 3 years they will not get interest on the balance amount.

Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit -regarding. As per paragraph 606 of EPF. Correspondingly the regular employees started depositing the matching.

So even if youre earning more than RM4000 a month the contribution from you and your employer is fixed at RM4000 leading to the maximum amount of contribution capped at RM1580 per month. Agriculture Infrastructure Fund Scheme Launched. Employee TA Reimbursement Excel Template.

Bear in mind that the contribution amount should be calculated based on the contribution rate as stated in the Second Schedule of the Employment Insurance System. For the Financial year 2019-2020 the pre-fixed rate of interest offered by the EPF scheme is 855. 1 lakh crore financial facility for agri-entrepreneurs startups agri-tech players and farmer groups for post-harvest management and nurturing farm assets.

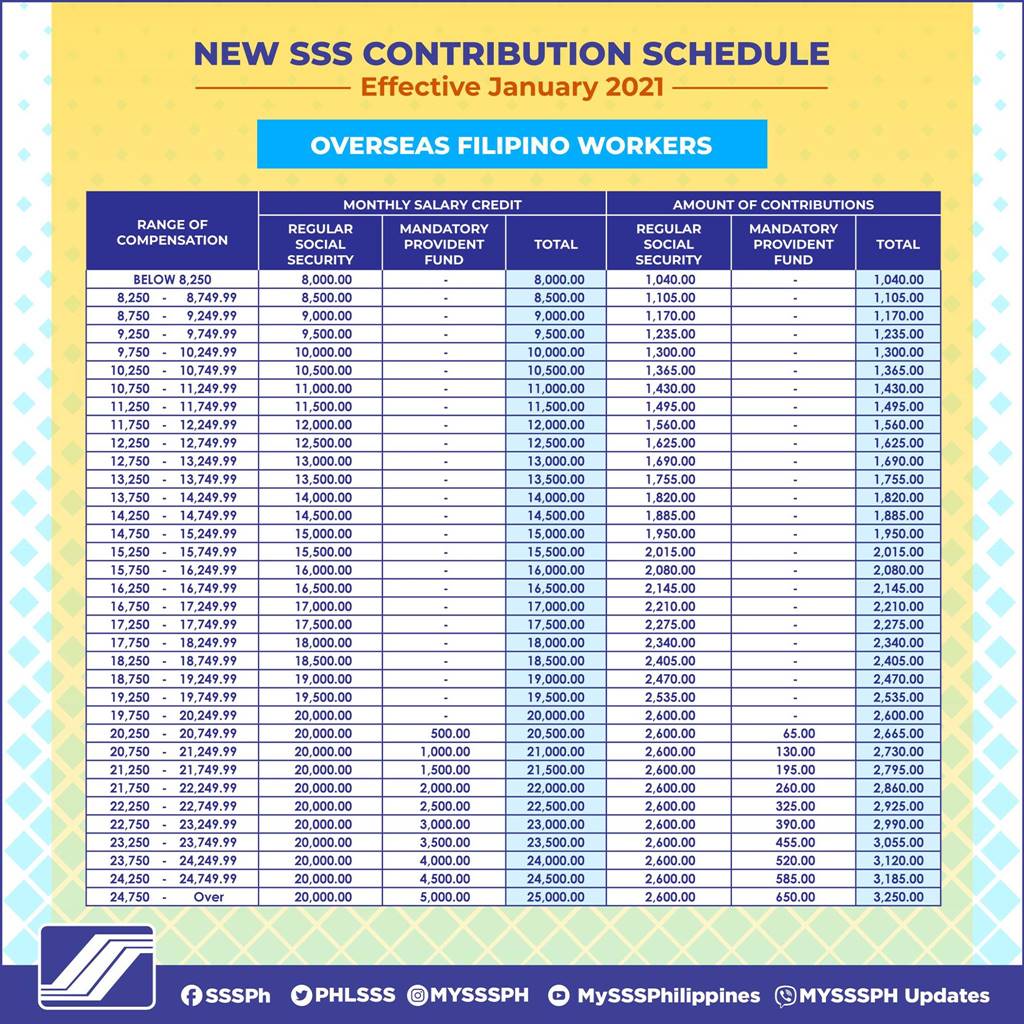

Secondly EPF account registration has compulsory for salaried employees with an income of fewer than 15000 Rs per month. On the other hand the maximum eligible monthly salary contribution is capped at RM4000. Access to internet banking makes EPF contribution payments much easier now.

15-03-2020 except sections 6 8 and 11 of the Act PU. 95 and the Fifth Schedule wef. Life insurance dan EPF.

October 2019 December 2019. The contribution rate for employees and employers can be referred in the Third Schedule EPF Act 1991 as a guide. The Government of Karnataka has revised dearness allowoanceDA payble in schedule employment vide Notification no.

Deferred Annuity and Private Retirement Scheme PRS - with effect from year assessment 2012 until year assessment 2021. Reporting Tax in Malaysia. Contribution means a contribution payable in respect of a member under a.

Like the Harmony and Tranquility modules the Columbus laboratory was constructed in Turin Italy by Thales Alenia SpaceThe functional equipment and software of the lab was designed by EADS. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule. However companies with less than 20 employees can join this scheme as well on the basis of Voluntary.

Employees Provident Fund Schemes. 23 On 26031987 the AppellantCompany instituted the Pawan Hans Employees Provident Fund Trust PF Trust wherein the management started depositing its share towards the provident fund contribution with respect to employees on the regular cadre of the Company. But in July 2017 Ministry of Labour Employment issued a clarification.

Contribution to the Social Security Organization SOCSO 250 Limited. A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act. July 2019 September 2019.

Percentage of EmployerCompany Contribution to EPF. Insurance premium for education or medical benefit. The Words except the State of Jammu and Kashmir omitted by Act 34 of 2019 s.

Monetary payments that are subject to SOCSO contribution are. Employees Provident Fund Amendment Act 2019. Foreign workers are protected under SOCSO as well since January 2019.

10 August 2020 Main Objective. Power to add to Schedule I. Employees Provident Fund EPF contribution.

Please refer to the notification for more information. Must Read Pension Plans for NRIs in India Inoperative EPF Account Confusion. Employee Resignation Schedule Excel Template.

DESSIPPWX012022 which is applicable from 1st April 2022 to 31st March 2023. Percentage of Basic salary contributed by Employee. Columbus is a science laboratory that is part of the International Space Station ISS and is the largest single contribution to the ISS made by the European Space Agency ESA.

The Agriculture Infrastructure Fund scheme is aimed at enabling the farmers to get greater value for their produce as they. Ministry of Finance Notification GSR. Both the rates of contribution are based on the total.

At First people from all the States in India except Jammu and Kashmir can apply under the provision of the EPF scheme. EPF is a deduction that the employer makes from your salary this contribution forms part of 80 C. Employers must remit the employees contribution share based on this schedule.

How Epf Employees Provident Fund Interest Is Calculated

Gold Price Chart For The Last 86 Years 14kgold Gold Price Gold Price Chart Gold Rate

20 Kwsp 7 Contribution Rate Png Kwspblogs

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Budgeting Dividend Tax

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Ppf 2019 Public Provident Fund Debt Investment Investing

8 Mac 2021 Commercial Marketing D I D

What Is The Epf Contribution Rate Table Wisdom Jobs India

New Sss Contribution Table 2019 With Computations Pinoymoneytalk Com Contribution Sss Employment Agency

Download Employee Provident Fund Calculator Excel Template Exceldatapro

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Sss Monthly Contribution Table Schedule Of Payment 2022 The Pinoy Ofw

Sss Contribution Table 2022 Sss Membership Benefits

How To Calculate Your Sss Contribution Sprout Solutions

Pin By Chin Eu On Epf Kwap Ltat Lth Pnb Ptptn Investing Periodic Table Estimate

30 Nov 2020 Bar Chart Chart 10 Things

Tax Saving Strategies For Latecomers Savings Strategy Saving Tax

Epf Employer Contribution Advisory Services Employer Covid 19 Assistance Programme E Cap Yau Co